Introduction

At its top it had a market cap of well over $16 billion and some of us were starting to believe that the concept of an algorithmic stablecoin was viable. Some of us even thought it was unbreakable when the creator of this algorithmic stablecoin announced a $10 billion backstop and the Curve4Pool. The Y2K Finance logo explains very well how it ended up … It’s undeniable that for a DeFi ecosystem to thrive, stablecoins are a hard requirement. However there are multiple variants and they all bear their own risks. Examples of these risks are related to:

The peg of the underlying asset

Censorship

Counter party risk

Y2K Finance eventually aims to become an insurance-like protocol for a myriad of stablecoins as well as pegged volatile tokens. Initially the protocol is set to launch with the following stablecoins: DAI, USDC, FEI, MIM and FRAX while the volatile assets include wBTC and stETH.

The launch of the platform is imminent and the project is foremostly centered around these products:

Earthquake⛰️

Wildfire🔥

Tsunami🌊

Earthquake

Before reading any further, it should be noted that ‘Earthquake’ is their flagship protocol. This product can be viewed as an options protocol and allows for multiple use cases such as hedging, speculating and underwriting of the risks in relation to the peg of certain assets.

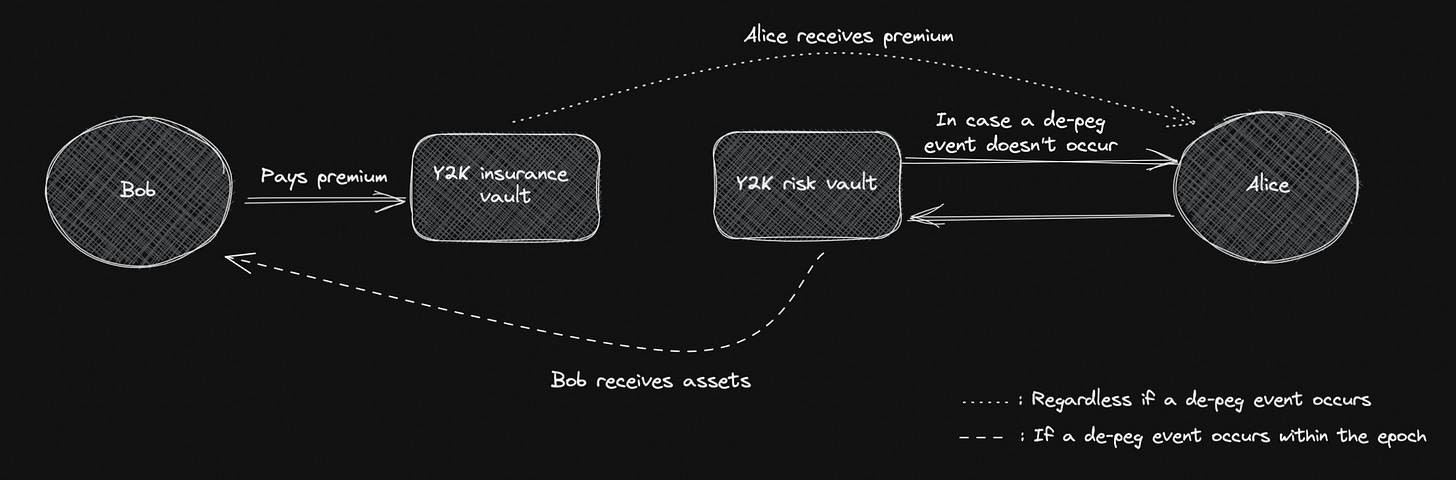

Bob pays a premium to ‘Y2K vault’ but has the right to receive a payout if the price of the agreed upon asset will reach a certain price threshold but, for the right to exercise this option, he is paying a premium to Alice.

Regardless of the fact if the option will be exercised or not, Alice will keep on to receive the premium she was initially promised before the start of the epoch. The settlement of this transaction will happen at the end of the epoch and thus making it effectively an American style options protocol.

But if you are Alice in this case, be aware of the potential risks you’re facing. The ‘yield’ might be juicy but it’s actually some form of premium for the potential risk that Bob has insured himself against in the case a potential de-peg event. This will subsequently lead to Alice losing her whole deposit.

This won’t be the only yield generating opportunity for depositors since (a part of the) funds in the vaults will be deposited in a money market to earn some idle yield instead of being unproductively stored inside the vault. On top of this, there might or might not be an incentive in the form of the native token of Y2K Finance for depositing funds into the protocol.

The team at Y2K finance has developed a framework to identify the risks and the associated de-peg event. I won’t touch on the equations behind it but the team came up with 3 different categories:

K1 - High risk category

This vault will by ratio pay out the highest yield but according to the Y2K team a de-peg event for these tokens occur approximately every 3 months.

K2 - Medium risk category

This vault will by ratio pay out a lower yield than the K1 vault but according to the Y2K team a de-peg event for these tokens occur approximately every 18 months.

K3 - Low risk category

This vault will by ratio pay out the lowest yield but according to the Y2K team a de-peg event for these tokens occur approximately only during black swan events.

Users will be able to enter the vaults once per month for the low strike vaults and once per week for the high strike vaults.

Wildfire

Y2K is going to build a Central Limit Order Book (CLOB) to offer the possibility to trade (de-pegged) positions during an epoch. On this exchange the positions can be traded as semi-fungible tokens that can be redeemed for a portion of the deposits from the collateral vault if a de-peg occurs. In this way traders can speculate (and potentially profit) without needing to lock-in their positions for a whole month on the platform while allowing vault depositors are able to (partially) exit their position prematurely.

Tsunami

Tsunami will introduce a GLP-like product to Y2K Finance and is an accumulation of multiple liquidity providers into one host liquidity pool which allows users to provide a mechanism for the gathering of numerous debt positions in multiple lending agreements. These various debt positions will be represented in a mechanism they ‘Collateral-Debt Obligation’ (CDO) and will be represented as ERC-1155 NFTs.

If a user decides to partake in the CDO by providing liquidity, they’ll be having exclusive access to a liquidation bot of which the yield, generated by liquidations, will be paid out to the depositors. By partaking in this process, a user will generate an additional revenue stream. The host liquidity pool will function as a dedicated loan underwriter that takes care of the whole process from monitoring to liquidating unhealthy positions. Let’s take a look at how the liquidation process looks like.

It’s actually pretty self explanatory, get liquidated if your Total Collateralization Ratio (TCR) reaches the threshold of <110%. What’s quite ironical here is that if you decide to partake in this process and your position gets liquidated, you’ll be buying a part of your own liquidated position since it’s a private vault.

Tokenomics

Tokenomics aren’t publicly disclosed as of the time of writing. However there’s a rumour that NEWO stakers will be eligible for an airdrop, this isn’t confirmed and at this point, it’s just mere speculation. What is already known is that there will be a revenue sharing mechanism, in total 30% of the platform revenue will be shared with the Y2K token holders whereas 70% will go to the treasury. The Y2K platform will incur a 0.25% fee on the premium paid out (to Alice in the case of the image above) as well as on Alice’s deposits to the vault. Since the funds in the vaults will be deposited in a money market, the gains will be taxed with 5% which will flow back to the platform.

Roadmap

First of, it should be said that ‘Tsunami’ is actually part of the roadmap but will be eventually a whole new part of the protocol as well. I cite the bulletpoints directly from their white paper:

Multichain stablecoins

Rebasing mechanisms to prevent position dilution in each vault

CDOs

Peg arbitrage vaults

Ability to lend semi-fungible tokens (for leverage and short-selling)

Auto-compounding of Y2K hedge deposits

Currently, the protocol is undergoing it’s security audit with Halborn security and has also put up Code4rena prize pool worth of $50.000. After speaking to some of the team members, the exact timing of the deliverables on the roadmap is yet to be announced, but it’s definitely worth to keep an eye out for when the new features will be rolled out.

It should be mentioned that this project is incubated by New Order Dao but that isn’t the only interesting contributor in my opinion. Some other noteworthy individuals who’ve contributed to this project include:

Thank you Mohdtalha125 for providing feedback on this article.

Disclaimer: Nothing in this article is financial advise and solely serves educational purposes. As of the time of writing, the author isn’t in possession of Y2K tokens however this might change in the future.