It’s been a while since my last article due to a few reasons, it’s not interesting to write *inhales* just another article, about just another forked project with just another mediocre team. To find a new and interesting project can be quite time consuming, however Spice Finance was worth my time to dive into, write about it and for you, to get to know more about it.

It can be quite a burdensome task, and challenging at times to be involved in the NFT borrowing and lending landscape due to a multitude of factors. The onerous elements a lender has to deal with shouldn’t be underestimated since there are quite a lot such as:

The different protocol models and the associated risks (P2P vs. P2Pool)

Negotiating a loan with your counterparty

Incorrect appraisal of the digital asset

But what if you’re a humble farmer that just wants to earn some yield? Well, meet Silkroad Finance … I mean Spice Finance. The name refers to the ancient Spice route, also known as the Silk Road, which started in China leading all the way into the Western part of the Eurasian continent. But since the former name sounds a bit sketchy, the latter seems like a perfect substitute.

How does Spice Finance works?

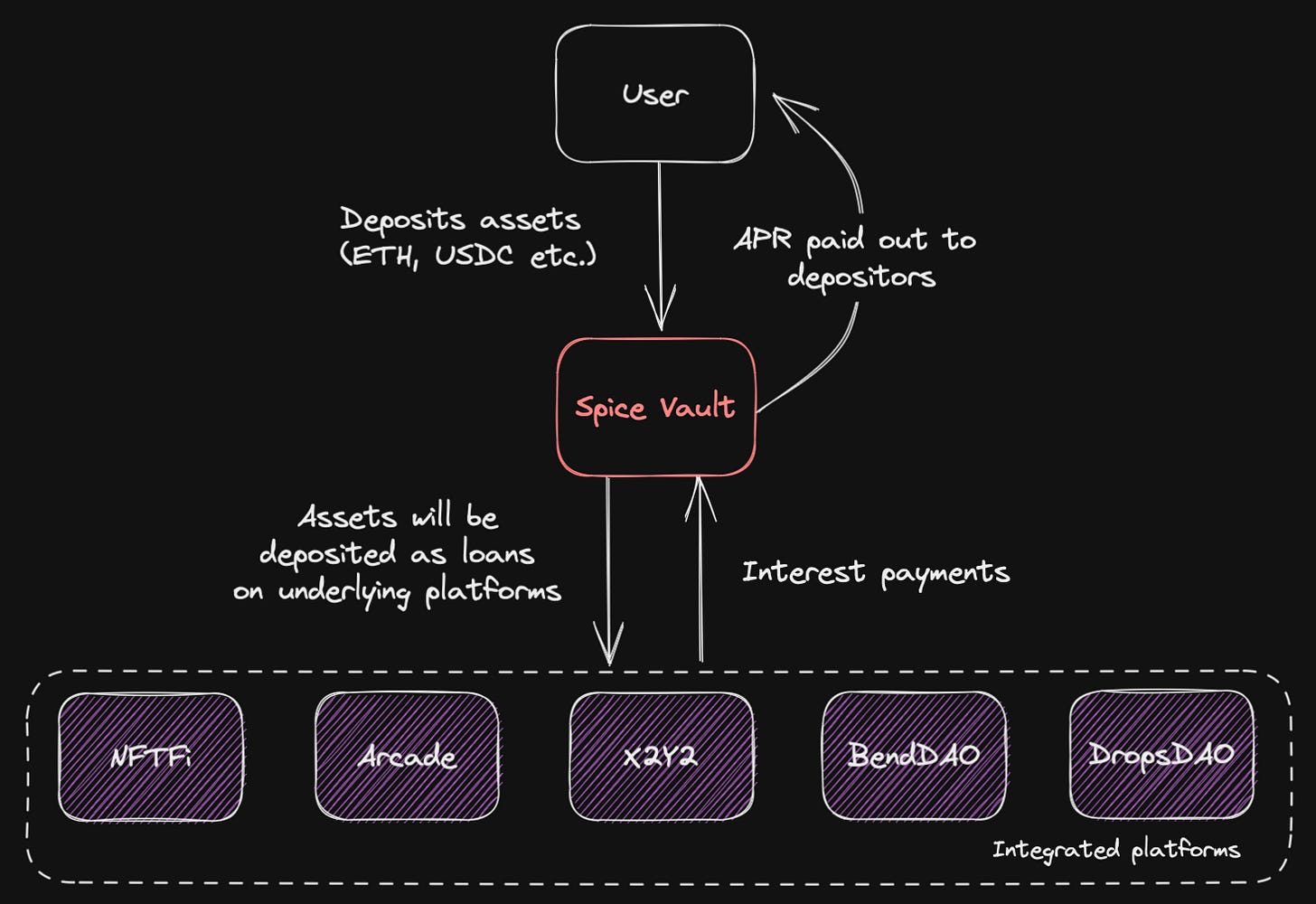

The concept is actually pretty clear to grasp, instead of personally bargaining the exact loan details with a counterparty, agree on the price of the asset etc., Spice Finance, built on the Ethereum blockchain, takes care of that. Let’s say you’re a yield hungry degen who just wants to earn some yield on his asset (ETH, DAI etc.), just deposit your funds into the vault of your choice and Spice Finance takes care of the rest. As a user you just sit back and relax, enjoy the interest paid by borrowers and see your initial deposit grow overtime, if users don’t default on their loan. If a borrower were to default on his loan, it usually doesn’t matter too much. Since the LTV is at maximum 60%, more often than not it’s even lower than the aforementioned number, so generally speaking there’s enough margin to prevent bad debt for the protocol.

There are two ways to keep track of your position, however it’s ultimately dependent in which vault you’ll be depositing your funds. In order to keep track of you position in the Prologue Vault, you’ll be receiving a (ERC-721) NFT as receipt tokens. In the near future, when other vaults launch (both the Flagship Vault and User-Spun Up Vaults) will adhere to the ERC-4626 standard and therefore a user will receive a ERC-20 as receipt token.

If this project would be doing these optimistic assumptions, I’d probably be writing about a L2 built on top of Ethereum – but Spice Finance is obviously not doing that. So, we’re hoping for the best while at the same time preparing for the worst possible outcome. How does Spice Finance navigate in this (potential) adversarial environment? Risk management. Measures are put in place, as first, the loan underwriting only happens on partner platforms which currently are:

The second step is to only offer loans for whitelisted collections, as of the time of writing that list contains 11 names. The ones that currently are allowed are your usual suspects such as BAYC, MAYC and Crypto Punks as well as other widely adopted collections. But … what if a user fails to repay his loan on some of his beautiful (or hideous, depending on who you’re asking) jpeg’s? Well … it’s going to be liquidated. But the circumstances on when it will be liquidated depends on the underlying platform. The P2P model has other liquidations parameters compared to the P2Pool model however there are some similarities.

P2P liquidation

This liquidation engine will be triggered when the borrower will be defaulting on his loan and won’t be able to make a repayment in time. The NFT will be transferred from the escrow contract to the lender (in this case Spice Finance) which will list the NFT on OpenSea at a (slight) discount relative to the current floor price.

However, there’s another liquidation mechanism and that is via the NFT-AMM better known as SudoSwap. If it’s economically more beneficial to sell via SudoSwap then the NFT will be directly sold into the designated liquidity pool. The proceeds of the liquidation will be flowing back to the vault depositors of Spice Finance.

P2Pool liquidation

This one is quite similar to the liquidation model of Spice’s P2P engine, however the main distinction are the exact parameters which ultimately will lead to the liquidation of a loan. If the loan of a user surpasses a certain threshold, usually a higher LTV than allowed, a user will be liquidated. From hereon the process will be similar, the NFT will be sent to the Spice Finance Vault which directly will try to sell it via a marketplace such as OpenSea or SudoSwap. Again, the proceeds of a liquidated asset will be flowing back to the depositors in the Spice Vault.

Portfolio rebalancing mechanism

Every vault has (liquid) ETH reserved and may at times have additional liquid ETH since P2Peer loans may have been repaid successfully and not be assigned to a new borrower yet. There aren’t too much details publicly disclosed as of now, but there’s a built-in rebalancing mechanism that automatically reallocates the liquid funds which aren’t assigned to a borrower. If the ETH isn’t locked up in a loan, it will be assigned to a P2Pool protocol and therefore earn some idle yield as well.

NFT appraisal mechanism

Something that isn’t completely solved yet in my opinion (and is quite challenging to achieve) is the appraisal of NFTs. The value that can be tied to an individual piece or even a whole collection is dependent on a lot of variables. In conjunction with this is that a substantial part of this process that is (highly) subjective. What I particularly like about the approach of Spice Finance is that they don’t try to come up with a whole new solution themselves but instead build on top of other appraisal mechanisms.

Spice Finance uses an aggregator which is built on top of other appraisal mechanisms such as:

If Spice Finance receives the outcome of its partners, the results of the ML models will be compared to a recent set of transaction data for the designated NFT collection. Subsequently the anomalies will be filtered out, based on this ‘clean’ data, the method that prices a collection the most accurate, will be chosen for its appraisal for the indicated NFT.

Prologue NFT

What would a MetaFi project be without it’s own jpeg collection? Well … I don’t want to offend other projects, so lets keep it in the middle. But I’d like you to meet Spice Finance’s Prologue NFT collection!

Just cool jpegs which actually don’t have any use case? Definitely not. It’s some esthetic artwork and holding the NFT entitles you to the following rights:

Early access to the unique features of Spice Finance

This one is quite self-explanatory, if the protocol is going to launch a new product you’ll be the one who’s getting the first access before the public.

White glove service

Getting early alpha and close connections to the team and being spoon-fed with the latest news and updates, I love features like this.

Boosted yield via Prologue Leverage

Are you looking for your Proof-of-Chad moment? Become a certified Spice Spartan and take out a loan against the ETH you’ve deposited in your Prologue NFT position. You’ll be able to take out a loan of up to 60% LTV, so lets say you deposited 10 ETH, it now allows you to take out a loan of 6 ETH against your position. Loop this and voilà, you’ve officially became a certified Spice Spartan.

There will be a total of 555 NFTs in circulation, the rarity traits will be depending on the amount of ETH you’ll be contributing to the mint in the first week. The initial mint price is 0.08 ETH and all contributions above that will be deposited in the Prologue Vault and determine the rarity traits you’ll be getting. After the first week, the metadata will be assigned and the traits of your NFT will be immortalized just as it happens with other NFT. Be aware that the mechanics have slightly changed, instead of one snapshot, now 7 snapshots will be taken during the first seven days at 5pm UTC to eventually determine the rarity traits of a user. In the 2 subsequent weeks a user can still deposit ETH into the Prologue Vault but starting from the third week, withdrawals will be enabled. The Prologue NFT will be tradable on the secondary market and what’s cool here is that the ETH that’s linked to your deposit can be transferred with it as well. Let’s make the calculation. Say you value your NFT on 1 ETH, you usually would list it on a marketplace like Blur for 1 ETH, but if you deposited 10 ETH in your Prologue position you don’t have to withdraw your funds. Instead, you can sell your Prologue NFT for 11 ETH.

Deposit with size? You likely will be rewarded with more rarity traits.

As of the time of writing, the Prologue NFT still has to be minted. The mint date will be on the 30th of January 2023 at 5pm UTC for whitelisted addresses only. Did you became excited but not whitelisted? Follow these requirements and you might get a shot to participate in this event. Keep in mind that obtaining a whitelist doesn’t automatically entitles you to mint the Prologue NFT since it already is massively oversubscribed.

On another note, at the moment there are no plans for a token however they may decentralize in the future. This is where it becomes interesting, maybe holders of the Prologue NFT and early supporters might be rewarded for their loyalty? I don’t know for sure yet and at this point it’s just worth a mere shower thought.

Team & partners

I think that you’re not only investing in a project but also should take into account that you’re investing in people. Well, the people working on Spice Finance seem very competent in my opinion given their extensive background in multiple DeFi native protocols such as OlympusDAO & JonesDAO. Some of the big brain chads working on the protocol are:

On top of this, it was announced on the 27th of October 2022 that Spice Finance raised 1.7M USD from its backers in a pre-seed round from parties such as:

In addition to these funds, there are some non-publicly disclosed angel investors involved as well.

If you thought that this was everything … well .. it isn’t. Besides having a chad team and good backers it’s definitely good to have ecosystem-wide integrations. To say that Spice Finance integrated throughout the whole MetaFi ecosystem is an understatement, however the nature of the collaboration(s) can slightly differ per partner protocol. Spice Finance partnered with the following projects (excluding the protocols which they’re building on top of since they’re mentioned already above): Abacus, Astaria, Insrt Finance, NFTPerp, Pine Protocol & Sodium. The partnership with these protocols entails co-marketing efforts and (future integrations if applicable).

Future

The first upcoming event is imminent and is the mint event of the Prologue NFT on the 30th of January. Shortly hereafter, the Prologue Leverage feature will be launched, subsequently the flagship vault will go live (for the public as well) and last but not least user spin up vaults will be available as well. However, exact dates on the launch of these products isn’t announced yet.

Features

Since Spice Finance is under active development there might be room to squeeze in new features which could enhance capital efficiency, user experience or allow for completely new products. This is just me ranting about potential new features that could be integrated by Spice Finance:

Put-covered vault

Suggested feature: Let’s say you’re the owner of BAYC #1234 and it’s valued at 100E. If you’re a Prologue NFT holder you’re allowed to take out a loan of up to 75E but only if there’s a put option for the same BAYC #1234 as well.

Rationale: First off, this feature brings more value to the holders of the Prologue NFT. In return, for the (relatively) high LTV, Spice Finance could charge a higher APR but still not be subjective to a potential default. If a user pays back his loan, Spice Finance will be paying the premium to the option buyer but the protocol would still pocket the difference between the paid interest and the APR it receives.

(Note that the exact parameters are mere suggestions and are open for discussion)

Leverage up via stablecoins

Suggested feature: Mint a stablecoin against your Spice Vault position

Rationale: Since your position will be created using an interest bearing token, the integration effectively allows you to create a loan that repays itself. A neat benefit on top of this is that users are effectively creating a short position on MiM when they sell the stablecoin. If MiM were to de-peg, users can scoop up MiM at a price < $1 and repay their loan with a discount since the loan is denominated in MiM. The smart readers have already noticed, in Spice Finance’s current form, leverage is only accessible to the holders of the Prologue NFT. Perhaps one day we’ll see spUSD but for now, especially since it isn’t the core business of Spice Finance, I think it’s good to contemplate (for now) about a primitive like spUSD.

Insurance fund

Suggested feature: There are no imminent plans for this but an insurance fund will be implemented in the future. I like the idea of a ‘native’ insurance funds by protocols, preferably I’d like to see it integrated rather yesterday than tomorrow.

Rationale: I’d only like to add here that it would be against smart contract risk on their own platform only and not their partner platforms. In addition to this, since NFTs are illiquid by nature, it might be good to spin up a ‘second’ insurance fund to prevent bad debt for the protocol, however the chance on bad debt is slim already. It might be an idea that 10% of the incurred fees can be split equally between these two forms of insurance funds.

Thanks to Spice Finance’s community members Shirtless & JIA for providing feedback on this article and sharing insights.

Disclaimer: Nothing in this article is financial advise and solely serves educational purposes. As of the time of writing, the author isn’t in possession of any Spice Finance (non) fungible assets but this might change in the future.