The case: Aark Digital

Executing decentralized trades while retaining centralized liquidity.

If you’d like to share this article, consider engaging with this tweet:

https://x.com/0xjermo/status/1711338009231298716?s=20

We have witnessed a product that has achieved a degree of product-market fit, establishing a respected brand and gaining recognition for its real yield (referring to GMX for those who may be unfamiliar). Generally speaking, whenever we encounter a new perpetual DEX (especially if built on Arbitrum), the first impression is: 'Why can Arbitrum developers only fork perp DEXs?' Well... while there are projects that are definitely unsophisticated spin-offs of existing dApps, I would argue that this does not applies to Aark.

Let's engage in a quick thought exercise. Metaphorically speaking, when creating a remarkable product, it is not always necessary to start from scratch. Instead, you can iterate upon the existing model and evaluate its compatibility with the overall vision you’re aiming to achieve. If the current model falls short, modifications must be made to meet your specific requirements, thereby fostering innovation. As with many aspects of life, innovation often follows a cyclical pattern.

Innovation cycle

There are multiple theories and frameworks that describe the innovation process, but for the sake of the article, I would like to keep this part concise. Generally speaking, the innovation of a product consists of these 5 steps:

Ideation:

This is the phase where ideas are generated, and potential concepts or solutions are identified.

Concept development:

Once ideas are generated, they are further developed into tangible concepts or prototypes.

Evaluation and validation:

Concepts are evaluated and validated through testing, market research, and feedback to assess their feasibility and potential success.

Implementation:

The chosen concept is transformed into a tangible product through design, development, and production processes.

Market introduction:

The final step involves launching the product into the market, promoting its features and benefits, and capturing customer interest and adoption.

Repeat.

If we had to plot this innovation cycle to perp DEXs, I’d say that GMX is the venue that laid ground for Aark Digital.

Aark Digital

Aark is a decentralized derivatives exchange that utilizes a Peer-to-Pool(P2Pool) liquidity model, offering flexibility to trade a wide range of assets beyond those confined to the liquidity pool.

Liquidity Pool Structure

The Aark Liquidity Pool (ALP) is similar to GMX in the sense that GLP utilizes the P2Pool model and it’s the place that accommodates the counterparty’s Open Interest (OI) and it comprises multiple assets, although it also possesses some distinguishing features. The ALP functions as the primary entity or "the house" where traders settle their trades. This effectively means that the value of the ALP will be affected according to the PnL of traders, trading fees and funding fees. Trades on the platform are cash settled, meaning that it doesn’t matter which asset a user is trading since their trading PnL is settled in virtual USD and can be withdrawn from Aark by withdrawing USDC out of the ALP.

Virtual USD

While the case with GLP is that it comprises a basket of assets, the input of your asset might not equal the same output as the backing of GLP over time changes as can be seen on the image below.

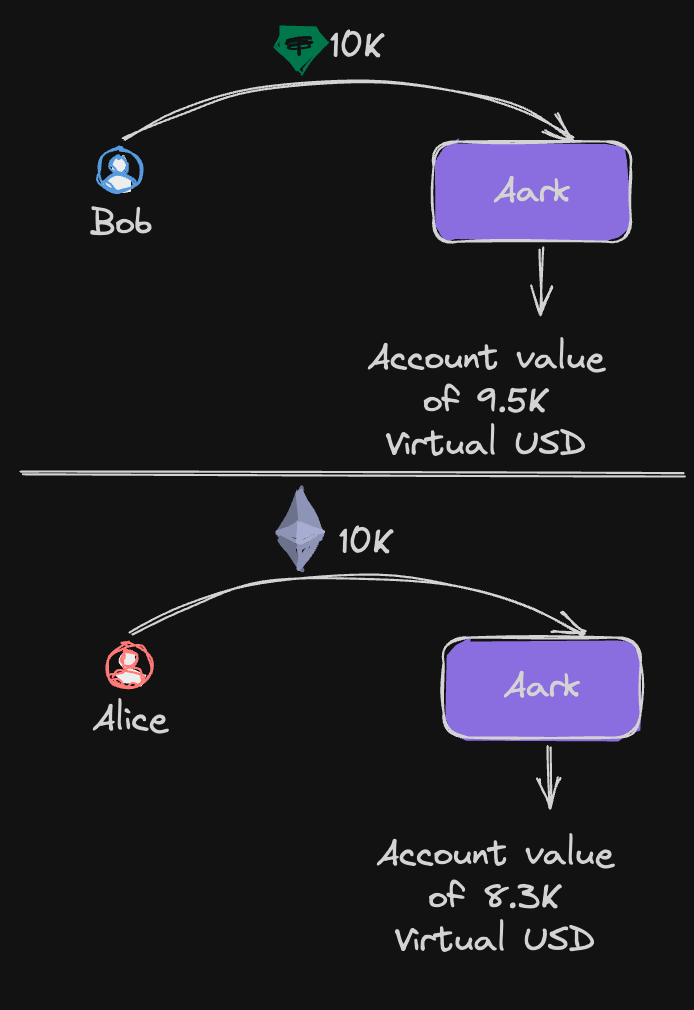

By utilizing this virtual USD (vUSD) model, it allows for long tail assets to be traded on the platform. In the event of traders realizing profits, the funds within the ALP decrease as they are paid out to traders. On the contrary, when traders realize losses, these losses are absorbed by the ALP, resulting in an increase of the total amount of funds in the pool and consequently, the deposited funds of participants. Furthermore, the ALP generates additional revenue through the accrual of trading fees, thereby leading to a steady increase of the pool over time. While the ALP has the potential to accommodate numerous assets, it will initially launch with the following assets, each assigned its specific weighting:

The total account value will be denominated in virtual USD (vUSD), and in terms of price, it mirrors the value of the US Dollar. Importantly, this value will not be hard-coded to the price of USDC. While USDC carries the same weight in a user's account balance as vUSD, it is essential to note that the total vUSD balance will always exceed the amount of USDC held in the protocol. This positive discrepancy arises from the overcollateralization of multiple assets with lower target weights (ETH, WBTC etc). This Dune dashboard created by the Aark team provides an overview of the ALP and the assets that are currently backing it.

As demonstrated below, there is a clear difference in the account values of both Alice and Bob due to the assets they have deposited.

As Aark implements the virtual USD model, users in the liquidity pool have the option to apply leverage of up to 5x to their ALP position, the leverage model here is a virtual model and thus not supplied by an external party. Since there’s no external party required to supply the extra leverage, LPs won’t pay borrowing fees to leverage LP with. While leveraging a position entails a risk of liquidation, the likelihood of liquidation is comparatively low in the ALP due to its relatively stability. In the event of an unfavorable position, liquidators will repay the outstanding USD balance, and the collateral will be transferred to them at a discounted price.

Trading engine

Aark has introduced a novel Market Maker Model known as the "Parallel Market Maker," which seeks to replicate the liquidity depth provided by exchanges with highly liquid orderbooks. To understand the unique aspects of Aark's market maker model, it is important to gain an understanding of several crucial components:

Mark price: The mark price is the quote price offered by the exchange, and it is the price at which a trader will ultimately execute a trade and looks as follows:

Mark price = Index price + premium

Index price: Aggregate price based off multiple exchanges.

Premium: This is the small additional amount paid by traders that depends on several variables. The premium has as benefits that it rebalances the OI (arbitrageurs are incentivized to take advantage of the imbalance) and stabilizes the market and LP. The premium can be calculated as follows:

Premium = Index price * skewness / depth factor / 100

Skewness: Skewness is a statistical measure that describes the asymmetry and deviation from the spot price and can be calculated as follows:

Skewness = long OI - short OI (Open Interest = OI)

Depth factor: The depth factor is a metric that signifies the quantity of active orders within a 1% range of the mark price found in the order book of a centralized exchange.

Funding fee: The funding rate is determined through a linear estimation using the premium, following a similar approach to CEXs but will be charged every block. The only distinction is the addition of an "amplifier" factor, which accounts for the risk level associated with the liquidity pool.

Price impact: This is the percentual change of how much the market price would change in correlation to the trading volume and looks like.

Price impact = Volume / depth factor

Depth factor

In the previous section, a brief explanation of the depth factor was provided. However, let’s dive a bit deeper into this concept via an example. The depth factor considers the total liquidity available within a 1% range of the current index price, aggregated from various centralized exchanges and can be visualized as follows:

For the purpose of this example, I have chosen to consider only two exchanges and utilized the average prices from these exchanges to simulate the depth factor of Aark in a hypothetical scenario. In the example there’s a total of 425 ETH available with in the 1% price range. So if a user will be executing a market buy order of 85 ETH the price impact will be having a 0.2% positive price impact. The introduction of the depth factor provides Aark with additional advantages:

Liquidity depth as if it were a centralized exchange - but decentralized

Allowing longtail assets to be traded on the platform

Aark fetches the liquidity order depth via Coin Metrics’s Low Latency perpetual future market price index. It retrieves the perpetual pricing data from Binance and OKX. Whereas the spot price is retrieved from Coinbase, Kraken and BinanceUS.

Funding fees

The implementation of funding fees attracts sophisticated market participants who engage in arbitrage to rebalance the OI to 50:50 (long:short). This matching system performed by these market participants contributes to the general market neutrality of the ALP. This effectively means that the ALP will take on the PnL if there is an imbalance in the OI (51:49) which is a common occurrence on multiple platforms that impose funding fees on an eight-hour interval.

On such venues, there is a tendency for one side of the trade (depending on the funding fee) to experience sudden price spikes during the moment that the funding rate needs to be paid for. This can pose additional risks to the counterparty, specifically the ALP. This eight-hour based architecture may result in an imbalanced long-short ratio, sometimes becoming as extreme as 90:10. Given the ALP's role as the counterparty, it faces the risk of a pool drain during exceptional market circumstances.

To mitigate this risk, as mentioned earlier, Aark has implemented a funding fee system based on block intervals. This architectural approach incentivizes arbitrageurs ,which specialize in funding fee trading, to continually rebalance the OI to the desired 50:50 ratio. As the PnL of long positions align with the PnL of short positions, the LPs largely maintain a market neutral position.

Security

There’s general consensus that most traders on (decentralized) trading venues are often unsuccessful. The assumption that’s being made here is that when traders lose, LPs win but there’s a bit more nuance to this assertion. It forces us to think about how directional risks are managed for LPs (liquidity providers). Specifically, the case of GMX and Vela Exchange will be explored to understand the negative impact on ALP holders. Following that, I’ll elaborate on the measures taken by Aark to mitigate this as much as possible.

The GMX incident

The most notable incident that happened to GMX is the ‘“exploit” that affected GMX on the Avalanche blockchain on September 18th. To be fair (and not anger the Blueberry Club), it was rather market manipulation than an exploit since GMX’s engine was working as intended. GMX was praised for their product offering with zero price impact and this turned out to be their Achilles heel.

To say that the chart below seems unnatural is an understatement, this was due to a trader opening relative huge AVAX positions without slippage on GMX, sent the AVAX to centralized exchanges and sold it there and repeated it 5 times. The total amount of profit made in this way is approximately around 565K USD (it should be noted that at this point in time it’s not clear what the net profit was of this person). The trader was able to do so due to the total market of AVAX being relatively illiquid and easier to manipulate compared to other, more liquid, assets.

The image above is from to Joshua Lim who wrote a concise post mortem about what happened.

For the savvy reader, I've made several mentions of GMX, but you may have noticed that I haven't addressed GMX V2 until now. I will now briefly delve into GMX V2 to highlight the differences and illustrate that Aark is not merely a fork of GMX (V2).

GMX V2

In its second iteration, GMX adopts isolated liquidity pools instead of relying on a single pool composed of multiple assets. These distinct pools are referred to as GMX Market Pools or more commonly known as "GM Pools.

These GM Pool consist out of three components, let’s take the ETH-USDC pool for example:

Long token (ETH)

Short token (USDC)

Index price feed (fetched from multiple exchanges)

With the introduction of this new GMX V2 model, synthetic pairs can also be traded; however, this synthetic market will tap into a portion of the available liquidity within the ETH-USDC pool.

Isolated liquidity pools for the same market can comprise multiple pools. For instance, a user can trade ETH in both the ETH-USDC pool and the ETH-USDT pool. While this may result in somewhat fragmented liquidity, it presents an opportunity for arbitrage trading (assuming there is an imbalance between these pools).

The LPs in the GM pools earn via:

Leverage trade fees

Borrowing fees

Swap fees

To safeguard the LPs in the GM Pools, GMX has implemented a funding fee (similar to regular perpetual futures) and a price impact mechanism. This means that liquidity on GMX V2 does carry a price, which differs from the situation I mentioned earlier regarding GMX V1. While certain similarities exist in the protective measures for LPs, there are fundamental differences in the architectural designs, with the most noteworthy distinction being the ALP, its scalability, and its theoretical ability to support a variety of assets.

VLP miscalculation

Another notable exchange that suffered from damage was Vela Exchange. According to their post-mortem there were significant deviations in the calculation of the value of the VLP token when USDC de-pegged in March 2023. This event led to heightened volatility in price feeds, resulting in front-running exploits where traders were able to generate excessive profits, reaching approximately one million USD. Despite traders being more net negative with their trades, the prices of VLP experienced higher-than-usual increases compared to previous weeks. These irregularities were identified through scrutinization of Dune dashboards and internal analytics.

It was determined that the problem stemmed from the inaccurate inclusion of trader PnL in the VLP price calculation. While the calculations for fees and liquidations were correct, deviations in PnL had a compounding effect on the value of VLP over time. Before discovering this issue, the price of VLP was relatively stability and was following price projections. However, the significant PnL deviations resulting from front-running exploits disrupted the expected trajectory of VLP's value.

Risk management for LPs

In this part I’d like to take a look at what happened in the past, how this eventually got mitigated and how Aark addresses these risks.

In the case of the GMX incident:

GMX doesn’t reflect the real cost of liquidity like other exchanges do, but instead offers ‘unlimited’ liquidity at a certain price.

Solution:

Right after the incident, GMX decided to cap the OI with 2M USD for long positions and 1M USD for short positions for AVAX.

Aark's OI model improves scalability by implementing limits based on net value rather than absolute OI. This ensures that the system's overall exposure and potential impact are maintained at acceptable levels, resulting in a more efficient and scalable OI structure.

Solution:

The pricing of liquidity can be solved by introducing a mechanism that takes liquidity depth into account, just as if were the case with centralized exchanges.

In the case of the Vela accident:

The current situation with Vela is the result of multiple factors coming together. It has come to my understanding that Vela is not fully prepared for a re-launch; however, they have recently announced a roadmap outlining their future plans.

Improperly accounted USDC balance

Solution:

In the case of Aark the price of virtual USD is not hardcoded to the price of USDC and due to the composition and weight factor of volatile assets, virtual USD is over collateralized.

Front running and oracle inefficiencies

Solution:

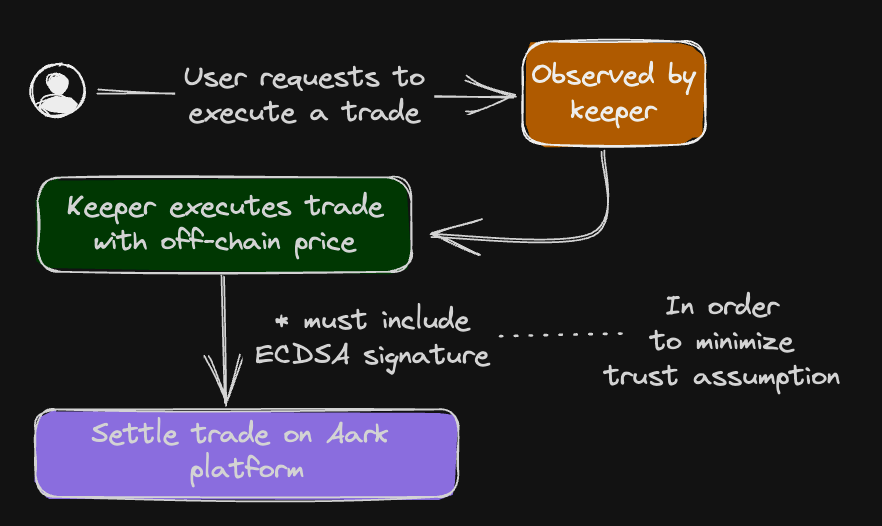

To prevent front running Aark chose to implement a two-order transaction system and utilizes Coin Metric’s Low Latency oracles, see the image below. Fun fact: Coin Metrics already serves as a data point for Chainlink’s price oracles.

The symbiotic relation between LPs and skewness

As previously stated, skewness represent the difference between the long OI short OI, and can be positive, neutral, or negative. Given that only a fraction of the outstanding orders (1%) is included in the depth factor, skewness is introduced to ensure proportional order distribution, thereby reducing excessive risk for LPs and minimizing unnecessary costs for traders. However there’s a limit on the amount of skewness that can be open at any given moment which are known as the soft- and hard skewness cap.

Soft skewness cap

In the context of OI and skewness caps, it is important to note that the size of OI cannot exceed the soft skewness cap when opening an order, which involves increasing the position size. However, closing orders are allowed if they don’t result in the size of skewness surpassing the hard skewness cap.

To illustrate this, let's consider an example. Suppose the soft skewness cap is set at 100 BTC, and the current skewness size is 99 BTC. If Bob, who already is long BTC, attempts to add 10 BTC to his long position, the order would be deemed invalid. This is because Bob would be adding to the position, causing the size of skewness to reach 110 BTC, which exceeds the soft skewness cap of 100 BTC.

Let's say Alice holds a short position of 2 BTC. If she decides to close her entire position, the order would be valid, even if it results in the size of skewness surpassing the soft cap. This is because Alice is closing her position, not opening it.

Hard skewness cap

The hard skewness cap sets a limit on the size of skewness, ensuring that it cannot exceed a predefined threshold. This restriction applies not only to opening up positions but also to closing positions. Even when attempting to close a position, if it would cause the skewness to surpass the hard skewness cap, the order won’t be accepted. If the skewness reaches the hard skewness cap, any order that contributes to further increase in skewness, whether it is a closing order or a liquidation order, won’t be accepted. However, to ensure the support for closing and liquidation orders in all circumstances, positions on the skewed side can be forcibly closed when the size of skewness exceeds the soft skewness cap. This process is referred to as deleveraging.

Other cool features

Traders on Aark are no longer required to individually cover transaction costs with ETH; instead, they can utilize USDC for gas payments. The amount of USDC will be subtracted from the account’s ‘futures’ balance.

Aark employs a two-order transaction system, yet it provides traders with the convenience of settling trades using a single wallet signature through a feature referred to as "1-Click Trading." This eliminates the need to sign multiple transactions, streamlining the trading process.

Audits

Throughout the past years, we have witnessed numerous instances of rugs, exploits, and hacks. To prevent this, Aark has implemented multiple security measures as mentioned earlier on in the article. In addition to this there are two audits the team has undergone. The first audit is carried out by Hacken and Aark has managed to get a staggering 8.5 for their overall product. I quote the report:

“As a result of the audit, the code contains 14 low severity issues. The security score is 10 out of 10.”

As of now, a second audit has been announced with a focus on security, which was conducted by Secure3 and the report can be found here. A total of 2 critical bugs and 5 medium bugs have been identified. In order to honor their commitment to security, Aark has announced a third audit scheduled to be conducted post-launch. The exact details of this third audit are however yet to be announced.

Insurance fund

The insurance fund is designed to offer supplementary protection to users in the event of unanticipated circumstances, such as liquidation failure, network downtime, or collateral defaults resulting from unforeseen market conditions. This external liquidity pool receives a portion of the liquidation bonus during each liquidation occurrence.

The LPs in this pool can withdraw their funds after waiting for three weeks after their withdrawal request and subsequently have a one week withdrawal period for the funds or else it will be locked again.

Tokenomics

I’d like to commence this paragraph by emphasizing the significance of well-crafted tokenomics combined with a superior trading experience that refutes potentially to Aark becoming one of the leading protocols on Arbitrum. If we consider one crucial lesson from the past, it is undoubtedly the fact that incentivizing trading is not a sustainable long-term approach. Let’s briefly examine another decentralized derivatives platform, namely dYdX, which incentivizes trading activity rather than prioritizing organic growth. On the chart below we can see protocol earnings based of the past 180 days which allows us to make a comparison between both GMX and dYdX.

What can be seen here is that GMX significantly outperforms dYdX in terms of generated revenue and token incentives. Additionally, GMX surpasses dYdX in terms of fees generated by both protocols. dYdX made 44.9M USD in fees over the past period, whereas GMX earned 85.3M USD in the same timespan. The strategy of the latter revolves around attracting liquidity and organically growing their TVL, which is also evident in their tokenomics. As such, Aark has replicated a major part of the GMX tokenomics. The first one has already been broadly discussed, namely the ALP, so I'll refrain from elaborating further on it. The second is the AARK governance token.

Aark token

The AARK token comes in two variants, the first one being the liquid ERC-20 token which is the transferable governance token and esAARK.

esAARK is the escrowed version of AARK and entitles users to a receive 40% of the revenue share, 50% will be going to LPs and the other 10% of the revenue will go to the treasury. The AARK token can be staked according to a tier-based system in which up to 40% of trading fees can be saved.

In total there will be 100 million AARK tokens and are allocated as follows:

Community Rewards: 31%

Team: 20%

Ecosystem: 17%

Early Investors: 16.3%

Future Investors: 4.7%

Core Contributors: 4%

Genesis Incentives: 4%

Advisors: 3%

For those seeking alpha opportunities, Aark is currently conducting Season 2 of their liquidity mining event that they call “Token Mining” which will commence on the 11th of October. During this event users of the platform can get additional incentives in the form of $AARK tokens for providing liquidity in the ALP as well as trading on the Aark platform. Due to the current size of the ALP relative to the trading volume the APR paid out in real yield is quite nice which is, as of the time of writing, 16.4% APR without direct token incentives. To be honest, a fair bit of the trading volume is probably generated in anticipation of the upcoming trade mining incentives. If you’d like to participate on the Aark platform you can do so and enjoy 0.1% trading fee that’s applicable across all assets and trading pairs. If you’d like to support me you could get a discount of up to 40% with this referral link.

Backers

In the dynamic world of blockchain, a symbiotic relationship between teams and investors is crucial for success. Teams rely on backers not only for financial backing but also for their industry experience, network, and strategic guidance. Investors seek promising teams with the potential to execute their vision and deliver on their promises. As such is the case with Aark as well and they’re backed by some of the most notable names in the industry, the round was led by Delphi Digital with participation from:

There are rumours about another well known market maker as well as a tier 1 exchange coming on board in a strategic follow up round. Also, look at the token distribution, might be nothing as well.

After writing the above, I am thrilled to announce that I will be aiding Aark Digital in executing their mission. Therefore, I will be stepping in as an advisor.

Roadmap

As of the time of writing, the product is almost ready to be deployed in a production environment but it’s a continuous development cycle. The immediate roadmap of Aark looks as follows:

Q4 2023:

Early Bird ALP Season 2

Trade Mining

Additional collateral types for ALP

Mobile Version

These are features I’m looking forward to see to come to fruition and be implemented in the near future.

In conclusion, perpetual DEXs are making progress overtime even though unfortunate events happened to both Aark’s predecessors & competitors. They have contributed to the collective development and insight of the DeFi space, hence my small rant about innovation early on in this article. However I think it’s time for next iteration of perpetual DEXs and I think that Aark embodies this vision.

Thanks to the Aark Digital team for feedback on this article.

Disclaimer: Nothing in this article is financial advise and solely serves educational purposes. As of the time of writing, the author isn’t in possession of AARK tokens however this will change in the future and the author is an advisor to Aark Digital as well as a liquidity provider in the ALP. This article is not sponsored content.